PREVECEUTICAL MEDICAL INC.

About PreveCeutical Medical Inc.:

PreveCeutical Medical Inc. (“PreveCeutical” or the “Company”) is a health sciences company that develops innovative options for preventive and curative therapies utilizing organic and nature identical products. PreveCeutical aims to be a leader in preventive health sciences and currently has five research and development programs, including: dual gene therapy for curative and prevention therapies for diabetes and obesity; the Sol-gel Program; Nature Identical™ peptides for treatment of various ailments; nonaddictive analgesic peptides as a replacement to the highly addictive analgesics such as morphine, fentanyl and oxycodone; and a therapeutic product for treating athletes who suffer from concussions (mild traumatic brain injury).

Click Here to view the PreveCeutical website

Click Here to view the PreveCeutical Investor Deck

Exchange: CSE

Symbol: PREV

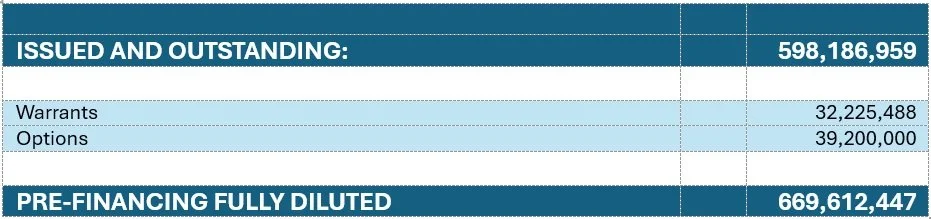

Corporate Structure:

Recent News Releases:

November 20, 2025 - PreveCeutical Provides Clarification of News Release Announcing Update on Plan of Arrangement with BioGene Therapeutics Inc.

November 20, 2025 - PreveCeutical Provides Uupdate on Plan of Arrangement with BioGene Therapeutics Inc.

October 30, 2025 - PreveCeutical Closes Second Tranche of Non-Brokered Private Placement

October 20, 2025 - PreveCeutical Provides Update on Plan of Arrangement with BioGene Therapeutics

September 19, 2025 - PreveCeutical Announces Mailing and Filing of Annual General and Special Meeting Materials in Connection with a Proposed Arrangement with BioGene Therapeutics

September 5, 2025 - PreveCeutical Closes Initial Tranche of Non-Brokered Private Placement

September 4, 2025 - PreveCeutical Announces Arrangement Agreement with BioGene Therapeutics

Plan of Arrangement with BioGene Therapeutics Inc.:

PrevaCeutical entered into a definitive arrangement agreement dated September 3, 2025 with its subsidiary, BioGene Therapeutics Inc. (“BioGene”), pursuant to which PreveCeutical intends to spin-out 12,000,000 common shares of BioGene (the “BioGene Spinout Shares”) to the shareholders of PreveCeutical (the “PreveCeutical Shareholders”) on a pro rata basis by way of a share capital reorganization effected through a statutory plan of arrangement (the “Arrangement”) pursuant to the Business Corporations Act (British Columbia) (the “BCBCA”). PreveCeutical received the BioGene Spinout Shares on November 15, 2024, in consideration for the sale of certain intellectual property assets to BioGene.

Pursuant to the Arrangement Agreement, PreveCeutical will, among other things, conduct a share capital reorganization whereby the existing common shares of PreveCeutical (the “PreveCeutical Shares”) will be renamed and redesignated as Class A common shares (each, a “PreveCeutical Class A Share”) and a new class of voting common shares (each, a “New PreveCeutical Share”) will be created. Each PreveCeutical Class A Share will be exchanged for one New PreveCeutical Share, and the number of BioGene Spinout Shares, which is equal to 12,000,000, divided by the number of issued and outstanding PreveCeutical Class A Shares on the effective date of the Arrangement. Once the Arrangement is complete, PreveCeutical Shareholders will own shares in two companies: BioGene, which will focus on the development of the Dual Gene Therapy program, and PreveCeutical, which will continue to focus on developing innovative options for preventive and curative therapies utilizing organic and nature identical products.

For more information on the Plan of Arrangement, please see:

News Release dated September 4, 2025; and

Information Circular in connection with seeking approval of the Plan of Arrangement at the October 10, 2025 AGM.

The statements and statistics contained herein were obtained from sources believed to be reliable, but Ascenta cannot represent that they are accurate or complete.

THIS INVESTMENT IS RISKY AND YOU COULD LOSE YOUR ENTIRE INVESTMENT AMOUNT.

Consult with your investment advisor, legal or tax professionals before investing.