ONE BULLION LTD.

About One Bullion Ltd.:

One Bullion Ltd. (“One Bullion” or the “Company”) is the largest gold exploration company in Botswana, offering an unmatched opportunity in a prime mining region.

Extensive Landholding

One Bullion controls 8,004 km² of Botswana with three promising gold projects, two of which have high discovery potential.

High Gold Potential

Three greenstone belts with 147 km exposure and 26 gold occurrences provide diverse exploration opportunities.

Favorable Jurisdiction

Botswana’s stable government and pro-mining policies create a secure environment for gold mining with reduced risks.

Click Here to view the One Bullion website

Click Here to view the One Bullion Investor Deck

Click Here to view the One Bullion Fact Sheet

Exchange: TSXV

Symbol: OBUL

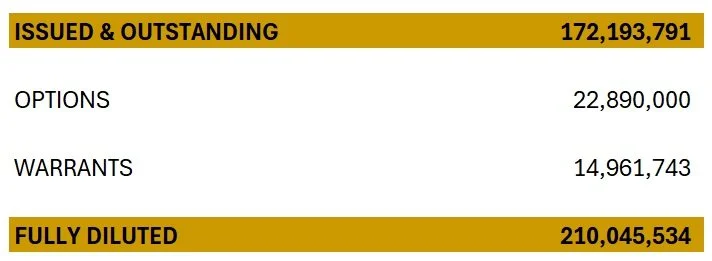

Corporate Structure:

Recent News Release:

January 27, 2026 - One Bullion Announces High Resolution Airborne Geophysical Survey to Advance Drill Targeting at Vumba and Maitengwe Projects

January 15, 2026 - One Bullion Provides Gold Market Update and Portfolio Progress

January 6, 2026 - One Bullion Announces Market Making Agreement

December 17, 2025 - One Bullion Limited Announces Closing of $5.3 Million Financing, Completion of Reverse Takeover and Expected Commencement of Trading on TSX Venture Exchange

October 9, 2025 - Imperial Ginseng Provides Further Update on Transaction with One Bullion

The statements and statistics contained herein were obtained from sources believed to be reliable, but Ascenta cannot represent that they are accurate or complete.

THIS INVESTMENT IS RISKY AND YOU COULD LOSE YOUR ENTIRE INVESTMENT AMOUNT.

Consult with your investment advisor, legal or tax professionals before investing.