CHARGER RESOURCE CORP.

Charger Resource Corp.

Raise of up to $800,000

Up to 1,600 Retractable Preferred Shares

Each Retractable Preferred Share is priced at $500

Retraction: Subject to the Company acquiring the Lincoln Property, at any time after the Company has received at least two thousand (2,000) ounces of gold mined from the Property from mining or any streaming, lease or other agreement, any holder of a Retractable Preferred Share may require Charger to purchase from the holder the whole of the Retractable Preferred Shares held by such holder by payment of one (1) ounce of gold for each Retractable Preferred Share.

Optional Conversion: At anytime up to 5 years from the issuance of the Retractable Preferred Shares, the holders of Retractable Preferred Shares may exchange each Retractable Preferred Share, which has not been previously retracted, for 500 Common Shares of Charger.

Automatic Conversion: If Charger’s common shares become listed on a recognized exchange, any Retractable Preferred Shares which have not been retracted or otherwise converted, will immediately convert to Units at no cost to the holder. Each Unit will consist of one common share and one share purchase warrant. The number of Units per Retractable Preferred Share will be $500 divided by a price equal to the maximum discount allowed by the Exchange with the warrant exercise price equal to 1.25 times the initial listing price of the Issuer’s shares on the recognized exchange. The warrants may be exercised for up to 2 years after the issue date.

Securities issued under this Offering will be subject to a standard 4 month hold period

This Offering is available to subscribers who qualify as accredited investors and, as well, under crowdfunding exemptions at Ascenta Opportunities

Exchange: Private

Symbol: Private

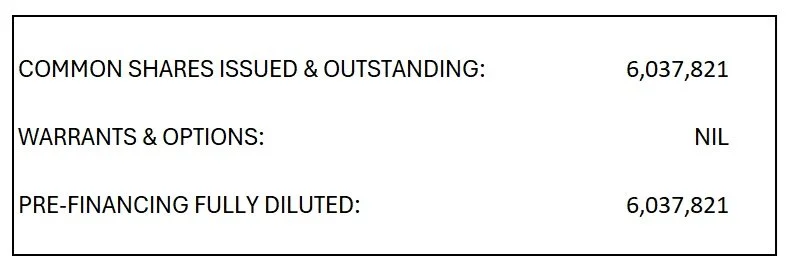

Corporate Structure:

Use of Proceeds:

Proceeds of the maximum ($800,000) offering will be used for:

land acquisition & development ($150,000)

finders’ commission ($64,000)

legal & accounting ($10,000)

general working capital ($576,000)

If you have an interest in participating or would like more information,

please contact Marshall Farris at 604-837-4774 or marshall@ascentafinance.com.

This Offering is available on a first-come, first-serve basis. Please express your interest in participating in this financing and we will attempt to hold a position for you. Once you have been confirmed, we will provide you with a Subscription Agreement

and Ascenta’s Know Your Client documentation.

About Charger Resource Corp.

Charger Resource Corp. (“Charger” or the “Company”) is a newly formed resource exploration and development company, incorporated in British Columbia under the Business Corporations Act (British Columbia) (the “Act”). The Issuer has not generated any revenue and has not conducted mining operations.

The Issuer has entered into a non-binding letter of intent (the “LOI”) dated December 15, 2025, with LPGC Mining Corp. (the “Seller”) to enter into a sale and purchase agreement (the “Sale and Purchase Agreement“) to acquire a 100% interest in placer mining claims in the Atlin mining district of British Columbia. The placer claims, colloquially known as the Lincoln Claim, Atlin Mining Division, located in or about Atlin, British Columbia Canada, is comprised of the claim listed below totaling 471.87 hectares (the “Property”, “Lincoln Property” or “Lincoln Creek”).

Click here to view the Charger Resource Website

Click here to view the Charger Resource Presentation

Click here to view the Charger Resource Offering Document prepared pursuant to NI 45-110 - Start-Up Crowdfunding Registration and Prospectus Exemptions in connection with its Crowdfunding offering of these securities available at Ascenta Opportunities

Investment Highlights

Receive Physical Gold - $500 CAD preferred share retractable to 1 oz of gold

Lincoln placer gold claim, estimated potential 400,000 oz in possible pay of 20 million CY*

Quick start-up, low capital cost surface mining potential (4)

Quick and cost-effective resource development potential

Lincoln Creek represents a rare opportunity - an untapped drainage in the prolific Atlin Gold Camp

Highly experienced management with expertise in exploration, placer mining, engineering

Charger has engaged with indigenous bands to initiate a mutually acceptable development path

About the Property

100% Canadian owned 472 Ha placer claims at Lincoln Creek, BC

The potential of Lincoln Creek placer is about 20 million cubic yards (“CY”) of possible pay*. If one were to assume an average grade of 0.02 oz/CY then the potential of the creek could be about 400,000 ounces of gold*.

Near surface volume of pay may be 3,000,000 CY*

Mining of very rich gravels should be possible right from the grassroots down*, very low strip ratio down to 1:1 with required infrastructure in place

The placer claims complement the 750-meter gold-pathfinder anomaly identified during the 2024 soil sampling program undertaken by Geologica Resource Corp.(2)

Today's mining equipment and technology can effectively manage the challenging ground conditions that defeated early miners

* Key assumptions, parameters and methods used to prepare the historical estimate, ‘Possible Pay’ are described by M.D. Kierans in his 1985, 1986 historical reports (ARIS Assessment Reports 14688, 14874) on the Property, “Possible Pay” does not refer to a mineral resource or mineral reserve and are not NI 43-101 compliant

Cautionary Statement Regarding Historical Estimates

The Company cautions that all the historical results, Possible Pay, potential and interpretations presented in this document were reported by previous investigations or other sources and have not been verified by a Qualified Person as defined by NI 43-101. The historical results, Possible Pay and potential reported here come from ARIS report 14688 by M.D. Kierans P.Eng., 1985. Possible Pay and potential are the original terminology used in ARIS 14688. The term Possible Pay or potential are not a mineral reserves or mineral resources as defined in NI 43-101. All key assumptions parameters and methods used to prepare the historical results are include in (Kierans, 1985). The Company believes the historical results in (Kierans 1985) are relevant in that they describe potential and induced the Company to stake the Lincoln placer claims and target future exploration but is unable to comment on the reliability of historical results as insufficient work has been done to make this determination. In addition, a Qualified Person has not done sufficient work to classify the historical results as current mineral resources or mineral reserves, and the Company is not treating the historical results as current mineral resource or mineral reserves. The historical results, Possible Pay in (Kierans, 1985) differs from a mineral resource or mineral reserve as defined in 1.2 and 1.3 of NI43-101 as it does not include the level of confidence of quantity and grade as required in NI 43-101, nor has the Possible Pay been verified by a Qualified person nor has a Qualified person been able to determine the Possible Pay has “reasonable prospects for eventual economic extraction”. The historical results may not be compliant with the current reporting standards and should be considered as non-compliant and non-current. The historical results, Possible Pay should not be treated as a potential gold resource. Charger Resource Corp. has not conducted any exploration work on the property to verify the historical results and will need to conduct a new and through evaluation to verify the historical results and to establish a compliant mineral resource or mineral reserve under NI 43-101 guidelines. Exploration work to verify the historical results may include passive seismic survey to verify the paleochannel and target future drilling to verify grade and Possible Pay The Company does not have any more recent estimates or data available to it.

PLEASE NOTE THAT ASCENTA AND/OR ITS MEMBERS MAY PARTICIPATE IN THIS OFFERING.

The Company has agreed to pay Ascenta a finders fee of 8% cash and 8% brokers warrants.

The statements and statistics contained herein were obtained from sources believed to be reliable, but Ascenta cannot represent that they are accurate or complete.

THIS INVESTMENT IS RISKY AND YOU COULD LOSE YOUR ENTIRE INVESTMENT AMOUNT.

Consult with your investment advisor, legal or tax professionals before investing.